Kicking off with Understanding Lifetime Customer Value, this topic delves into the key aspects of customer value that drive business growth and success. From calculating to enhancing, this discussion covers it all in a way that resonates with the savvy business minds of today.

What is Lifetime Customer Value?

Lifetime Customer Value (LCV) is a crucial metric that measures the total revenue a business can expect from a customer throughout their entire relationship with the company. It takes into account the repeat purchases, referrals, and upsells that a customer is likely to make over time.

Understanding Lifetime Customer Value is essential for businesses because it helps them make informed decisions about marketing strategies, customer acquisition costs, and overall business growth. By knowing the value of a customer over time, businesses can allocate resources more effectively and tailor their marketing efforts to maximize profitability.

Calculating Lifetime Customer Value

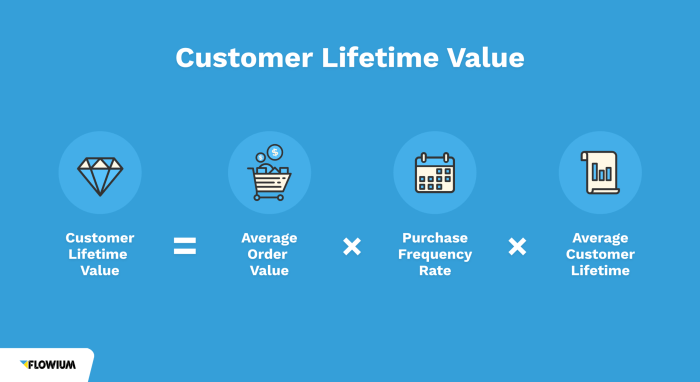

To calculate Lifetime Customer Value, businesses typically use the following formula:

Lifetime Customer Value = Average Purchase Value x Average Purchase Frequency x Customer Lifespan

– Average Purchase Value: The average amount of money a customer spends on each purchase.

– Average Purchase Frequency: How often a customer makes a purchase within a specific timeframe.

– Customer Lifespan: The length of time a customer continues to make purchases from the company.

Factors Influencing Lifetime Customer Value

- The quality of products or services offered by the company

- The level of customer satisfaction and loyalty

- The effectiveness of marketing and customer retention strategies

- The overall customer experience and relationship with the brand

- External factors such as economic conditions and market competition

Importance of Understanding Lifetime Customer Value

Understanding Lifetime Customer Value is crucial for businesses as it helps in making strategic decisions that can drive long-term success. By knowing the value a customer brings over their entire relationship with a company, businesses can allocate resources effectively and tailor marketing strategies to maximize profitability.

Contribution to Customer Relationship Management

Lifetime Customer Value plays a significant role in customer relationship management by allowing businesses to identify their most valuable customers. By understanding the worth of each customer, companies can personalize their interactions, provide better customer service, and build stronger relationships that lead to increased loyalty and retention.

Role in Predicting Customer Behavior

Lifetime Customer Value also helps in predicting customer behavior. By analyzing past purchasing patterns and interactions, businesses can anticipate future actions of customers. This insight enables companies to proactively address customer needs, offer relevant products or services, and prevent churn by implementing retention strategies.

Examples of Successful Businesses

Many successful businesses prioritize understanding Lifetime Customer Value to drive growth and profitability. For example, Amazon uses sophisticated algorithms to analyze customer data and provide personalized recommendations, leading to increased sales and customer satisfaction. Similarly, Starbucks leverages customer insights to offer loyalty programs and targeted promotions, enhancing customer engagement and driving repeat business.

Calculating Lifetime Customer Value

When it comes to calculating Lifetime Customer Value (LCV), businesses use various methods to determine the worth of a customer over their entire relationship with the company. By understanding how much a customer is expected to spend over time, businesses can make informed decisions about marketing, customer retention, and overall strategy.

Different Methods for Calculating LCV

- The Historic LCV Method: This method involves looking at past customer data to predict future spending patterns. It relies on historical data to estimate the value of a customer.

- The Predictive LCV Method: This method uses predictive analytics and data modeling to forecast future customer behavior. It takes into account factors such as customer demographics, purchase history, and engagement levels to predict lifetime value.

Step-by-Step Guide to Calculate LCV

- Calculate Average Purchase Value: Total revenue divided by the number of purchases.

- Calculate Average Purchase Frequency: Total number of purchases divided by the number of unique customers.

- Calculate Customer Value: Average purchase value multiplied by average purchase frequency.

- Calculate Average Customer Lifespan: Average number of years a customer continues purchasing.

- Calculate LCV: Customer value multiplied by average customer lifespan.

Pros and Cons of Different Approaches

- The Historic LCV Method:

- Pros: Relies on actual customer data, easier to implement.

- Cons: Does not account for changes in customer behavior, can be less accurate for new customers.

- The Predictive LCV Method:

- Pros: Uses advanced analytics for more accurate predictions, considers various factors.

- Cons: Requires sophisticated data modeling, may be more complex to implement.

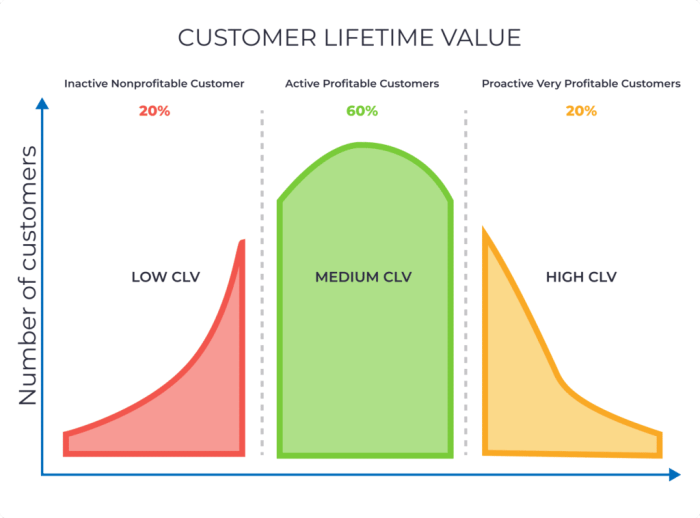

Real-World Impact of Accurate LCV Calculations

Accurate LCV calculations have a significant impact on business strategies. For example, a company with high LCV customers may decide to invest more in customer loyalty programs to retain these valuable customers. On the other hand, a business with low LCV customers may focus on acquiring new customers to increase overall lifetime value. By understanding LCV, businesses can tailor their strategies to maximize profitability and long-term success.

Enhancing Lifetime Customer Value

In order to increase Lifetime Customer Value, businesses can implement various strategies and programs to enhance customer experience and satisfaction.

Strategies for Increasing Lifetime Customer Value

- Offer personalized promotions and discounts based on customer preferences and purchase history.

- Implement a loyalty program that rewards customers for repeat purchases.

- Provide exceptional customer service to build trust and loyalty with customers.

- Upsell and cross-sell products or services to increase the average order value.

Successful Customer Retention Programs, Understanding Lifetime Customer Value

- Amazon Prime: Offers free shipping, exclusive deals, and streaming services to encourage repeat purchases and loyalty.

- Sephora Beauty Insider: Rewards customers with points for purchases, special events, and personalized product recommendations.

- Starbucks Rewards: Gives points for every purchase, offers free drinks, and provides a personalized experience through the mobile app.

Enhancing Customer Experience

- Invest in training employees to provide excellent customer service and create positive interactions.

- Use customer feedback to improve products, services, and overall experience.

- Create a seamless omnichannel experience for customers to engage with the brand across multiple platforms.

Relationship between Customer Satisfaction and Lifetime Customer Value

Customer satisfaction plays a crucial role in determining Lifetime Customer Value. Satisfied customers are more likely to make repeat purchases, become brand advocates, and contribute to the overall success of the business. By focusing on enhancing customer satisfaction through various strategies and programs, businesses can increase Lifetime Customer Value and drive long-term growth.