Budgeting for Families kicks off with the importance of managing finances together, offering a fresh perspective that promises to revolutionize your approach to money matters. Dive into a world where budgeting is not just a chore, but a family adventure towards financial freedom and stability.

Importance of Budgeting for Families

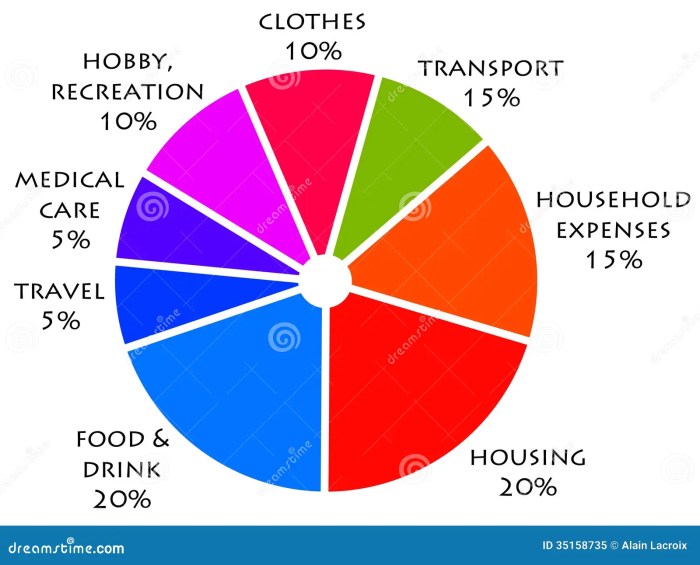

Budgeting is crucial for families as it helps in managing finances effectively, ensuring financial stability, and preparing for unexpected expenses. By creating a budget, families can track their income and expenses, identify areas for saving money, and prioritize their spending to meet their financial goals.

Impact of Effective Budgeting

- Ensures financial stability by avoiding overspending and accumulating debt.

- Helps in building emergency savings for unexpected events like medical emergencies or job loss.

- Allows families to plan for future expenses such as education, retirement, or buying a home.

Benefits of Involving Children in Budgeting

- Teaches children the value of money and the importance of saving and budgeting from a young age.

- Encourages responsibility and accountability in children towards their spending habits.

- Promotes open communication within the family about financial matters and fosters a sense of teamwork in achieving financial goals.

Setting Financial Goals as a Family

Setting financial goals as a family is crucial for ensuring everyone is on the same page when it comes to managing money and working towards a common objective. It helps in fostering communication, teamwork, and accountability within the family unit.

Importance of Setting Financial Goals Together

- Encourages collaboration and shared responsibility.

- Creates a sense of unity and purpose among family members.

- Helps in prioritizing spending and saving decisions.

Examples of Short-Term and Long-Term Financial Goals

- Short-Term Goals:

- Long-Term Goals:

Setting up an emergency fund for unexpected expenses.

Planning a family vacation within the next year.

Reducing monthly expenses by a certain percentage.

Saving for children’s education or college fund.

Buying a family home in a specific neighborhood.

Retiring comfortably with a set amount of savings.

Aligning Financial Goals to Strengthen Family Bonds, Budgeting for Families

- Working towards a common financial goal can enhance trust and communication.

- Celebrating milestones and achievements together can build a sense of accomplishment.

- Supporting each other in financial challenges can strengthen family relationships.

Creating a Family Budget

When it comes to creating a family budget, it’s important to follow a structured approach to ensure financial stability and achieve your financial goals. Here are the steps involved in creating a comprehensive family budget:

Choosing a Budgeting Method

- Zero-Based Budgeting: This method requires allocating every dollar of your income to specific expenses, savings, or debt payments, leaving no money unaccounted for.

- Envelope System: With this method, you allocate cash to different envelopes for various spending categories, helping you visually track your expenses and stay within budget.

Tracking Expenses Effectively

- Keep Detailed Records: Use a budgeting app or spreadsheet to track your expenses and income regularly.

- Set Realistic Limits: Establish realistic spending limits for different categories to avoid overspending.

- Review Regularly: Review your budget periodically to make adjustments based on your actual spending and income.

Teaching Kids About Money Management: Budgeting For Families

Teaching kids about money management is crucial for their future financial well-being. By instilling good money habits at a young age, children can develop a strong foundation for making responsible financial decisions later in life.

Age-Appropriate Ways to Introduce Basic Financial Concepts

- Start with the basics: Teach young children the value of money by showing them how to count coins and bills.

- Use real-life examples: Take advantage of everyday situations to explain concepts like spending, saving, and budgeting.

- Set up a savings jar: Encourage kids to save a portion of their allowance or gift money in a clear jar so they can see their savings grow.

- Play money-related games: Board games or online simulations can make learning about money fun and engaging.

Long-Term Benefits of Instilling Good Money Habits in Children

- Financial independence: Children who learn to manage money early are more likely to become financially independent adults.

- Responsible decision-making: Understanding the consequences of financial choices can help kids make responsible decisions as they grow up.

- Less debt: Teaching kids about budgeting and saving can help them avoid falling into debt traps in the future.

- Confidence: Kids who are knowledgeable about money management feel more confident and in control of their financial futures.